Standard Deduction 2023 Ca . Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and $ 446.00 per. We update the following annually: Web do you qualify for the standard deduction? Web announcing the 2023 tax tier indexed amounts for california taxes. You can claim the standard deduction unless someone else claims you as a dependent. Web california to adjust withholding methods for 2023. If you make $70,000 a year living in california. Web 2023 california tax rates, exemptions, and credits. The rate of inflation in california, for the period from june 1, 2022, through june.

from www.nerdwallet.com

If you make $70,000 a year living in california. Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. Web do you qualify for the standard deduction? Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and $ 446.00 per. You can claim the standard deduction unless someone else claims you as a dependent. Web california to adjust withholding methods for 2023. The rate of inflation in california, for the period from june 1, 2022, through june. Web announcing the 2023 tax tier indexed amounts for california taxes. We update the following annually: Web 2023 california tax rates, exemptions, and credits.

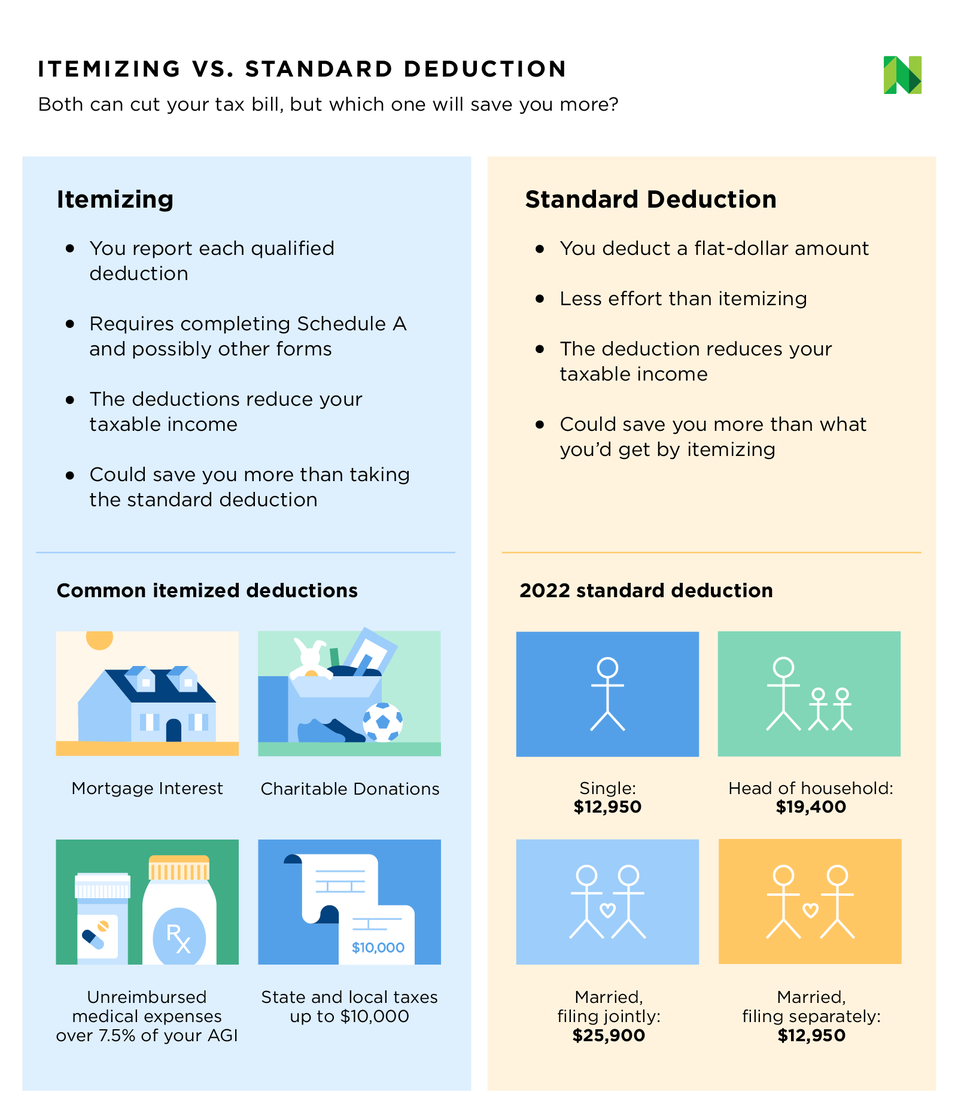

What Are Itemized Deductions? Definition, How to Claim NerdWallet

Standard Deduction 2023 Ca You can claim the standard deduction unless someone else claims you as a dependent. You can claim the standard deduction unless someone else claims you as a dependent. The rate of inflation in california, for the period from june 1, 2022, through june. Web announcing the 2023 tax tier indexed amounts for california taxes. Web 2023 california tax rates, exemptions, and credits. Web do you qualify for the standard deduction? Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and $ 446.00 per. Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. Web california to adjust withholding methods for 2023. We update the following annually: If you make $70,000 a year living in california.

From www.freemanlovell.com

2023 Tax Rates and Deduction Amounts Standard Deduction 2023 Ca Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. The rate of inflation in california, for the period from june 1, 2022, through june. Web do you qualify for the standard deduction? We update the following annually: If you make $70,000 a year living in california.. Standard Deduction 2023 Ca.

From wikinbiography.com

Standard Deduction 2023 What will be the amounts for next year? Wiki Standard Deduction 2023 Ca Web 2023 california tax rates, exemptions, and credits. Web california to adjust withholding methods for 2023. Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and $ 446.00 per.. Standard Deduction 2023 Ca.

From angilantoinette.pages.dev

Fed Tax Rates 2024 Ailsun Teirtza Standard Deduction 2023 Ca We update the following annually: Web announcing the 2023 tax tier indexed amounts for california taxes. Web 2023 california tax rates, exemptions, and credits. Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. You can claim the standard deduction unless someone else claims you as a. Standard Deduction 2023 Ca.

From www.canbyfinancial.com

Potentially Bigger tax breaks in 2023 Standard Deduction 2023 Ca Web do you qualify for the standard deduction? If you make $70,000 a year living in california. Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. Web california to adjust withholding methods for 2023. Web announcing the 2023 tax tier indexed amounts for california taxes. You. Standard Deduction 2023 Ca.

From honorleonanie.pages.dev

Standard Deduction 2024 Wynny Roxane Standard Deduction 2023 Ca The rate of inflation in california, for the period from june 1, 2022, through june. You can claim the standard deduction unless someone else claims you as a dependent. Web announcing the 2023 tax tier indexed amounts for california taxes. We update the following annually: Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single. Standard Deduction 2023 Ca.

From taxexcel.net

Section 16 of the Tax Act for Financial Year 202324 Standard Deduction 2023 Ca Web california to adjust withholding methods for 2023. Web announcing the 2023 tax tier indexed amounts for california taxes. Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and $ 446.00 per. Web do you qualify for the standard deduction? The rate of inflation in california, for the period from june 1,. Standard Deduction 2023 Ca.

From testsumus.oxfam.org

Printable Small Business Tax Deductions Worksheet Check Out This Standard Deduction 2023 Ca If you make $70,000 a year living in california. Web announcing the 2023 tax tier indexed amounts for california taxes. Web do you qualify for the standard deduction? Web california to adjust withholding methods for 2023. You can claim the standard deduction unless someone else claims you as a dependent. The rate of inflation in california, for the period from. Standard Deduction 2023 Ca.

From www.xoatax.com

Standard Deduction 2023 Guide for Different Filing Status Standard Deduction 2023 Ca We update the following annually: Web announcing the 2023 tax tier indexed amounts for california taxes. You can claim the standard deduction unless someone else claims you as a dependent. Web do you qualify for the standard deduction? If you make $70,000 a year living in california. Web california provides a standard personal exemption tax deduction of $ 144.00 in. Standard Deduction 2023 Ca.

From imagetou.com

Federal Household Guidelines 2023 Image to u Standard Deduction 2023 Ca You can claim the standard deduction unless someone else claims you as a dependent. Web california to adjust withholding methods for 2023. Web do you qualify for the standard deduction? Web 2023 california tax rates, exemptions, and credits. The rate of inflation in california, for the period from june 1, 2022, through june. If you make $70,000 a year living. Standard Deduction 2023 Ca.

From www.nerdwallet.com

What Are Itemized Deductions? Definition, How to Claim NerdWallet Standard Deduction 2023 Ca We update the following annually: Web california to adjust withholding methods for 2023. Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. Web announcing the 2023 tax tier indexed amounts for california taxes. Web california provides a standard personal exemption tax deduction of $ 144.00 in. Standard Deduction 2023 Ca.

From www.myxxgirl.com

Federal Tax Deduction Chart My XXX Hot Girl Standard Deduction 2023 Ca If you make $70,000 a year living in california. You can claim the standard deduction unless someone else claims you as a dependent. Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and $ 446.00 per. Web 2023 california tax rates, exemptions, and credits. Web the california standard deduction for 2023 tax. Standard Deduction 2023 Ca.

From lessondbgerste.z13.web.core.windows.net

Standard Deduction Worksheets For Dependents Standard Deduction 2023 Ca Web california to adjust withholding methods for 2023. Web do you qualify for the standard deduction? Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. The rate of inflation in california, for the period from june 1, 2022, through june. We update the following annually: You. Standard Deduction 2023 Ca.

From elysiaqvitoria.pages.dev

2024 Tax Brackets Married Jointly Single Latia Christyna Standard Deduction 2023 Ca Web california to adjust withholding methods for 2023. Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. We update the following annually: Web 2023 california tax rates, exemptions, and credits. Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying. Standard Deduction 2023 Ca.

From renaezilvia.pages.dev

California Tax Rates 2024 Married Jointly Gabey Jocelin Standard Deduction 2023 Ca Web announcing the 2023 tax tier indexed amounts for california taxes. Web do you qualify for the standard deduction? Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. We update the following annually: If you make $70,000 a year living in california. Web california provides a. Standard Deduction 2023 Ca.

From 1040taxrelief.com

2022 Tax Rates, Standard Deduction Amounts to be prepared in 2023 Standard Deduction 2023 Ca Web 2023 california tax rates, exemptions, and credits. You can claim the standard deduction unless someone else claims you as a dependent. Web california to adjust withholding methods for 2023. Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. Web do you qualify for the standard. Standard Deduction 2023 Ca.

From arlinabmariska.pages.dev

California Tax Brackets 2024 2024 Single Alene Arleyne Standard Deduction 2023 Ca Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and $ 446.00 per. The rate of inflation in california, for the period from june 1, 2022, through june. Web california to adjust withholding methods for 2023. If you make $70,000 a year living in california. Web do you qualify for the standard. Standard Deduction 2023 Ca.

From filmfanatics.net

Listed here are the federal revenue tax brackets for 2023 Film Fanatics Standard Deduction 2023 Ca You can claim the standard deduction unless someone else claims you as a dependent. Web do you qualify for the standard deduction? If you make $70,000 a year living in california. Web announcing the 2023 tax tier indexed amounts for california taxes. Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and. Standard Deduction 2023 Ca.

From www.youtube.com

Standard Deductions 2023 What You Should Know!! YouTube Standard Deduction 2023 Ca We update the following annually: Web the california standard deduction for 2023 tax returns filed in 2024 is $5,363 (single or married filing separately) and $10,726 (married filing. Web announcing the 2023 tax tier indexed amounts for california taxes. Web california provides a standard personal exemption tax deduction of $ 144.00 in 2023 per qualifying filer and $ 446.00 per.. Standard Deduction 2023 Ca.